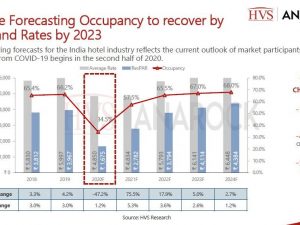

HVS ANAROCK’S report titled ‘India Hotels Outlook’ that studies the impact of COVID-19 on the Indian hotel sector estimates that assuming recovery from COVID-19 begins in H2 2020, occupancy would then recover only by year 2022, touching 66%, while rates would recover by year 2023.

Read More »Indian hotel sector could lose Rs 90,000 cr revenue

An HVS ANAROCK report on the impact of COVID-19 on the Indian hotel sector pegs the total revenue loss for the sector in 2020 at Rs89,813 crore, with the maximum to be borne by the unorganised segment.

Read More »Chennai and Mumbai top performing markets based on RevPAR: HVS ANAROCK

While RevPAR has been low throughout the country, Chennai and Mumbai have been the top performers ( with -83% and -83.3% RevPAR YoY) in May 2020, according to HVS ANAROCK monthly newsletter, H2O.

Read More »77% drop in hotel occupancy compared to May 2019: HVS ANAROCK

HVS ANAROCK’S latest monthly newsletter titled ‘Hotels & Hospitality Overview India’ reveals that the hotel occupancy rate in May 2020 witnessed a y-o-y drop of 76.7 per cent compared to the same period last year, making India rank fourth among five key Asian markets, followed by Thailand.

Read More »Post-COVID hospitality will change in terms of design & operations: Mandeep Lamba

Mandeep Singh Lamba, President – South Asia, HVS ANAROCK, has said that the hospitality industry would see changes in terms of design and operations after the COVID-19 crisis is over. Speaking at the third TravTalk Digital Conclave, he said, “There are going to be some permanent changes that will happen in the industry, both in terms of operations of the hotels and in terms of design. We need to understand that this is perhaps not the last time we are seeing a disruption of this kind. It’s a reality which can hit us again, and hence we need to be far better prepared the next time. This crisis has stirred the industry into making some serious changes.”

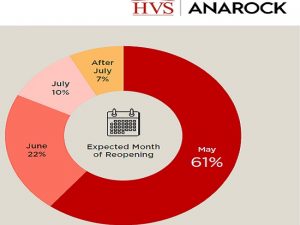

Read More »Over 60% hotels are preparing to reopen post lockdown: HVS ANAROCK GMs Survey

In its latest General Manager’s Sentiment Survey, HVS ANAROCK has reported that over 60 per cent of the General Managers (GMs) are preparing to open their hotels as soon as the lockdown is lifted this month. The survey suggested that upscale business properties are expected to open sooner than others. The anonymous online survey captured responses of 160 GMs across branded hotels PAN India. 74 per cent of the responding GMs were from the business hotels while rest 26 per cent represent leisure hotels.

Read More »Hotel occupancy decline lowest in India among 5 key Asian countries: HVS

The recently-released HVS ANAROCK monthly newsletter titled ‘Hotels & Hospitality Overview’ reveals that among five key Asian markets – India, China, Malaysia, Thailand and Singapore – India had the lowest y-o-y decline in hotel occupancy for March at 52.9 per cent, while China witnessed the highest at 65.4 per cent. Malaysia, Thailand and Singapore witnessed occupancy declines of 64.7 per cent, 62.6 per cent and 53.6 per cent, respectively, for the said period. The report suggests that occupancies across hotels in key Indian cities witnessed a sharp decline, as travel restrictions intensified and India went into lockdown towards the end of March 2020.

Read More »Branded hotels in India could lose up to $4.1 billion in revenue: HVS ANAROCK

The branded segment is expected to witness a revenue loss of US$ 3.55 billion to US$ 4.1 billion in 2020 and the second quarter of the year will be the worst hit, says Mandeep S Lamba, President – South Asia, HVS ANAROCK. “The overall revenue of the Indian hotel sector, including both organised and unorganised segments, is set to decline by anywhere between US$ 8.85 billion to US$ 10 billion, reflecting an erosion of 39-45 per cent compared to the previous year. Hotels will be unable to drive rates and may even seek to attract business at deep discounts,” he adds. With new confirmed cases being reported daily, the penetration of the COVID-19 virus in India has caused mass hysteria, the reverberations of which are expected to continue well into the second quarter of the calendar year 2020.

Read More »105 more branded hotels expected to open in 2019 than in 2018: HVS ANAROCK

The year 2019 is expected to outpace 2018 with a total of 105 new branded hotel openings with a total key count of 8,574 keys, revealed HVS ANAROCK in its recent report. It revealed that the effort to open new hotels, big or small, requires hotel operators to coordinate large amounts of preopening effort. So, while domestic operators opened 65 hotels of the total 134 openings in 2018, which represents nearly half of all the openings, in terms of key counts, domestic operators represented only 32% of the total 7,215 keys.

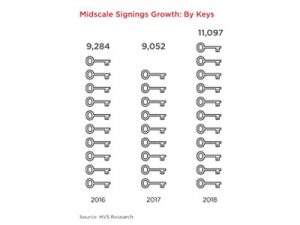

Read More »11,097 keys for midscale hotels signed in 2018

A total of 11,097 keys for midscale hotels were signed in 2018, as compared to 9052 keys in 2017 and 9284 keys in 2016, revealed a report by HVS ANAROCK. The report stated that the value-driven volume customer, seeking a full- service hotel continues to drive the growth in midscale space, leaving far behind the branded economy segment, which is yet to fully find its footing in the Indian market. To add further fuel to fire, the relatively new-kids-on-the-block and considered to be outliers, such as Oyo, Treebo and Fabhotels have very quickly come to dominate the economy segment, setting the goal post a further drift for the mainstream brands.

Read More » Tourism Breaking News

Tourism Breaking News