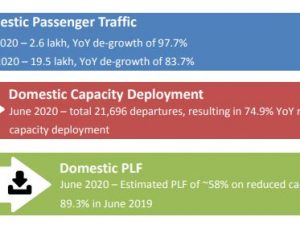

In view of the ongoing Covid-19 outbreak, the domestic airlines are operating at a lower capacity – total 21,696 departures in June 2020, as against 86,456 departures in June 2019, resulting in a 74.9% YoY reduction in capacity deployment, reveals ICRA. For June 2020, the domestic passenger traffic was 19.5 lakh, as against 119.9 lakh in June 2019, a YoY de-growth of 83.7%. For May 2020 (25th to 31st), the domestic passenger traffic was 2.6 lakh, as against 115.6 lakh in May 2019, resulting in a YoY de-growth of 97.7%.

Read More »FY2021 expected to witness 41-46% de-growth in domestic passenger traffic

As per an ICRA study, though restricted recommencement of domestic air traffic has begun, this will in no case help the industry to recover lost ground in FY2021. Overall, FY2021 is expected to witness 41-46% de-growth in domestic passenger traffic. However, H2 FY2021 will witness some recovery.

Read More »Indian aviation could lose up to Rs90 crore a day with operations shut down

According to ICRA estimates, considering the operating expenses of the Indian aviation industry in FY2019 and that 35-42 per cent of their expenses are fixed in nature, it is estimated that the industry will report a net loss of Rs 75-90 crore per day of shutdown of operations. While some airlines have sufficient liquidity and/or financial support from a strong parentage, which will help them tide over this disruption, some airlines, who are already in financial stress, will face serious troubles.

Read More »Number of premium rooms across 12 key cities to go up to 98,900 by FY2023: ICRA

The number of premium rooms across 12 key cities is likely to go up from 82,800 in FY2018 to 98,900 as on FY2023, with ICRA research tracking about 16,100 premium rooms under construction and to be launched over the next five years. The Indian hotel industry witnessed its highest ever 10-year occupancy in FY2018 and its revenue per available room (RevPAR) was higher by 17 per cent compared to the 10-year low, witnessed in FY2014. Similarly, the pan-India average room rate (ARR) which stood at Rs 5,800 in FY2018, was also the highest since FY2014, according to a recent research by ICRA. Foreign Tourist Arrivals (FTAs) into India slowed down from April 2018 onwards due to the Nipah virus scare and diversion of traffic to other global events such as the soccer world cup in Russia. While the FTAs growth picked up in Aug 2018, the Kerala floods impacted it in Sep and Oct 2018. Kerala witnessed decline in FTAs in Q2 (-4.6 per cent) and Q3 CY2018 (-13.6 per cent). In addition, there was general weakness in the global ITAs during Q3 CY2018. As for the domestic demand momentum, it has remained strong; the domestic revenue passenger kilometre (RPKM), a proxy for domestic travel grew by a robust 20.3 per cent year on year (YOY) in YTD October CY2018 at ~ 10.5 million passengers. Domestic demand in FY2019 will continue to be driven by increased air connectivity and higher appetite for domestic leisure travel. On the supply side, the supply of room is likely to lag demand over the medium term and grow at a subdued CAGR of 3.6 per cent over the next five years (FY19-23).

Read More »ICRA expects improved yields in Indian aviation in 2018

Healthy passenger load factors (PLFs) supported by a decline in competitive intensity due to moderation in capacity addition and suspension of operations of three regional airlines has augured well for the industry profitability. This coupled with a gradual improvement in the core growth drivers like economic environment, tourism demand and regulatory support and a strong demand during the peak season is expected to support the industry profitability during H2 FY2018. Improved tourism demand, policy measures like the National Civil Aviation Policy and the Regional Connectivity Scheme and start of economic revival are the key positives for the industry. However, inadequate aviation infrastructure, which has constrained the performance of airlines, remains a bottleneck. According to Kinjal Shah, Assistant Vice President & Co-Head – Corporate Sector Ratings, ICRA, “The industry has done well to mitigate the impact of 8.7 per cent YOY increase in ATF prices during H1 FY2018. The increased ability of the airlines to pass on the costs to the customers due to reduced competitive intensity has resulted in an increase in the revenue per available seat kilometer (RASK)-cost per available seat kilometer (CASK) spread for the airlines, and the financial performance of most of the airlines improved during the current year.”

Read More »Domestic traffic growth undeterred by demonetisation: ICRA

According to ICRA, domestic air passenger traffic has been undeterred by demonetisation with a robust YoY growth of 24 per cent in December 2016. The growth was propelled by peak season demand along with prevalent low airfares due to intense competition. The traffic growth on international routes was however impacted slightly, with the industry reporting 7.7 per cent YoY growth during the month. Nevertheless, performance of Indian carriers on international routes was better than the industry, with 16.1 per cent growth in traffic. Domestic passenger traffic growth was healthy at 22.9 per cent during 9m FY2017. Anand Kulkarni, AVP and Associate Head, Corporate Sector Ratings, ICRA Limited, “ICRA has been emphasising on pressure on profitability of airlines operating in the country due to competitive environment and increasing aviation turbine fuel (ATF) prices in the current fiscal and the same has been reflected in decline in profitability of the listed airlines in Q3 FY2017. As per ICRA estimates, the fuel cost per ASKM (CASK) of the domestic aviation industry increased to Rs. 1.08 in December 2016 from a low of Rs. 0.82 in February 2016 and the same is expected to increase further in Q4 FY2017. Going forward, the profitability of the airlines would be negatively impacted in Q4 FY2017 as the airline yields continue to remain under pressure and the ATF prices maintain the uptrend. The ATF prices in February 2017 are ~50 per cent higher on YoY basis. Further, the capacity addition in the industry is expected to continue at a healthy pace given the proposed fleet expansion plans of various airlines.”

Read More » Tourism Breaking News

Tourism Breaking News