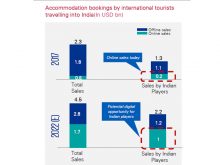

International tourists’ spend on hotels in India expected to grow at a CAGR of approximately 14 per cent by 2022, as per a latest study by KPMG and Google. Indian players currently enjoy a 55 per cent share of revenues in the accommodation industry. This is expected to reduce to 50 per cent by 2022 as international players plan to expand aggressively into Tier I and Tier II cities in India. Accommodation providers in these cities are set to witness influx of international travellers. Cities like Manali, Ooty, Gangtok are gaining popularity. Tier I and Tier II cities see the majority of leisure travel spending (approximately 87 per cent of overall international tourist spending is for leisure purposes). The accommodation market in these cities is dominated by several small and unorganised Indian players.

International tourists’ spend on hotels in India expected to grow at a CAGR of approximately 14 per cent by 2022, as per a latest study by KPMG and Google. Indian players currently enjoy a 55 per cent share of revenues in the accommodation industry. This is expected to reduce to 50 per cent by 2022 as international players plan to expand aggressively into Tier I and Tier II cities in India. Accommodation providers in these cities are set to witness influx of international travellers. Cities like Manali, Ooty, Gangtok are gaining popularity. Tier I and Tier II cities see the majority of leisure travel spending (approximately 87 per cent of overall international tourist spending is for leisure purposes). The accommodation market in these cities is dominated by several small and unorganised Indian players.

Indian players have tapped into the opportunity through tie-ups with multiple sales representation companies for lead generation, global promotion campaigns and loyalty programmes. Promotional activities are supported by comprehensive marketing campaigns globally.

Select large players have set up hotels overseas whereas smaller players depend on international travelers visiting India as it is challenging for these players to operate internationally without the desired scale. Online travel aggregators play an important role in organising the fragmented market and bridging the accessibility gap for international travelers by creating a transparent ecosystem.

Breaking News

- PDMF 2025 to kick off from 1 Dec in Thailand’s Chiang Rai, to spotlight wellness, culture & destination reinvention

- MPTB gets ‘Best State – Tourism Board’ recognition at India Travel Awards

- Visa-free travel could unlock new destinations for 91 % Indian tourists: Agoda

- Policy changes result in shortage of trained guides, TGFI urges station-specific training

- Robust travel demand fuels IHCL’s domestic RevPAR up 9% in H1, global 11%: Parveen Chander Kumar

- Vivek Aggarwal gets additional charge as Tourism Secretary

- Me’gong Festival 2025 to Shine with Global Icons in Garo Hills

- The all new Oberoi Rajgarh Palace opens in Khajuraho, Madhya Pradesh

- GRT Hotels hosts ‘GReaT Conversations’, an all-women panel on emerging travel trends & evolving guest behaviour

- Rail Europe hosts fam trip for key India and GCC partners

- Bengal becomes India’s second most-preferred foreign tourist destination, posts 14.8% growth in 2024

Tourism Breaking News

Tourism Breaking News