In 2024, India’s hospitality sector shifted focus to tier II and III cities like Amritsar and Bikaner, accounting for nearly half of hotel transactions, as per JLL report. CY 2024 witnessed 42,071 keys in terms of branded hotel signings and 11,352 keys in terms of branded hotel openings. As many as 77 per cent of these signings were concentrated in tier II and III cities.

Read More »38 branded hotels open in Q4 2024, enhance capacity by 3,293 rooms, says JLL India report

As per JLL India report, as many as 38 branded hotels comprising 3,293 rooms were opened during Q4 (October-December) 2024. Additionally, December 2024 also saw signings of 99 branded hotels comprising 11,943 rooms with the top six markets experiencing year-over-year increases in both Average Daily Rate (ADR).

Read More »India’s hospitality sector registers 4.8% YOY growth in revenue per available room in Q2 2024: JLL report

According to JLL’s Hotel Momentum India report the hospitality sector recorded a 4.8% growth in revenue per available room (RevPAR) in Q2 of 2024. Despite lower occupancy due to summer vacations, the industry expects a busy upcoming quarter driven by corporate travel and social events.

Read More »Bengaluru records highest RevPAR growth of 110.6% in Q4 2022 (Oct-Dec): JLL

According to JLL’s latest Hotel Momentum India (HMI) Q4, 2022, Bengaluru emerged as the RevPAR growth leader in Q4 2022 with 110.6% growth over Q4 2021, followed by Mumbai and Delhi with a YoY growth of 105.3% and 94.3% respectively.

Read More »RevPAR for Indian hotels increased by 340% YoY in Q2 2022 over Q2 2021: JLL

The Indian hospitality sector witnessed strong growth in Q2 (April – June) 2022, according to JLL’s Hotel Momentum India (HMI) Q2, 2022. Revenue Per Available Room (RevPAR) witnessed an exponential growth of 339.3 % year-on-year (YoY) in Q2, 2022 over Q2 2021.

Read More »Goa records highest RevPAR in Q1 2021, Bengaluru saw sharpest decline: JLL

Goa recorded highest RevPAR in absolute terms, despite the single digit decline of RevPAR by 1.1% in Q1 2021 as compared to Q1 2020, revealed JLL’s Hotel Momentum India (HMI) Q1 2021. The report highlighted that Bengaluru saw the sharpest decline of 60.6% in RevPAR compared to the same period of the previous year. High demand from domestic leisure travelers make Goa the fastest recovering market in absolute RevPAR terms

Read More »One in almost every five hotels signed in 2020 was a converted hotel

According to JLL, hotel conversions in India had seen a consistent increase, nearly doubling from 33 conversions in 2016 to 65 in 2019. However, the conversions plummeted to just 29 hotels in 2020 under the impact of the pandemic. The uncertainty in the market made existing or committed hotel owners adopt a cautious approach than take conclusive investment decisions.

Read More »International hotel operators dominate signings in India

JLL’s quarterly hospitality sector monitor – Hotel Momentum India (HMI) Q3 2020 – reveals that for the said period, international operators dominated hotel signings over domestic operators with the ratio of 53:47 in terms of inventory volume. There were a total of 24 signings in Q3 2020, totalling 2,314 keys.

Read More »RevPAR in Bengaluru down by 59%: JLL

According to a JLL report, Bengaluru’s hotel sector performance declined 59% in RevPAR in YTD July 2020 (YoY) but is expected to bottom out in Q4 2020 as domestic travel gains momentum. Occupancy was also down 53% YTD July (YoY).

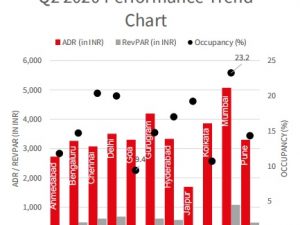

Read More »Mumbai leads in RevPAR, ADR & occupancy

JLL’s Q2 2020 performance trend chart revealed that Mumbai continues to be RevPAR leader in absolute terms despite the decline of RevPAR by 81% in comparison to Q2 2019. All key 11 markets in India witnessed a decrease in RevPAR Performance in Q2 2020 over the same period last year Mumbai continues to be the RevPAR leader in absolute terms, despite the decline of RevPAR by 81% in Q2 2020 compared to Q2 2019 Goa saw the sharpest decline in RevPAR in Q2 2020, with a 93.9% decline compared to the same period in the previous year. ‘Vande Bharat Mission’ remains a major demand generator for hotels in key cities. Total no. of signings in Q2 of 2020 stood at 7 hotels comprising of 673 keys, witnessing a decline of 83% of signings in terms of inventory over the same period last year. International hotel operators dominated signings over Domestic operators with the ratio of 63:37 in terms of inventory volume.

Read More » Tourism Breaking News

Tourism Breaking News