As per HVS Anarock’s recent report, the nationwide ARR of hotels has seen a growth of 10 to 12% while the ARRs remained in the range of ₹9,100 to ₹9,300. This growth in ARRs reflected positively on the RevPARs of hotels resulting in a growth of 15 to 17%. The RevPAR of hotels crossed the ₹6,000 threshold whereas the RevPAR of hotels in January 2025 was in the range of ₹6006 and ₹6,324.

Read More »Hospitality sector to witness 9-11% year-on-year increase in RevPAR by Q2 FY25: Motilal Oswal report

As per Motilal Oswal report, the hospitality sector will witness growth in Q2 FY25. The key players will see RevPAR growth of 9-11 per cent YoY in Q2 FY25, which will be driven by pent-up demand, improved traction within convention centers, and stronger wedding season.

Read More »India’s hospitality sector registers 4.8% YOY growth in revenue per available room in Q2 2024: JLL report

According to JLL’s Hotel Momentum India report the hospitality sector recorded a 4.8% growth in revenue per available room (RevPAR) in Q2 of 2024. Despite lower occupancy due to summer vacations, the industry expects a busy upcoming quarter driven by corporate travel and social events.

Read More »India-wide occupancy likely to reach 66% in 2023, RevPAR 18% higher than 2019: HVS

Mandeep Singh Lamba President (South Asia) HVS ANAROCK said, “We expect India-wide occupancy to improve to 66% in 2023 coupled with a 16-17% increase in ARR will push RevPAR to ₹4,690 during the year, almost 18% higher than the pre-pandemic RevPAR recorded in 2019.”

Read More »RevPAR for Indian hotels increased by 340% YoY in Q2 2022 over Q2 2021: JLL

The Indian hospitality sector witnessed strong growth in Q2 (April – June) 2022, according to JLL’s Hotel Momentum India (HMI) Q2, 2022. Revenue Per Available Room (RevPAR) witnessed an exponential growth of 339.3 % year-on-year (YoY) in Q2, 2022 over Q2 2021.

Read More »Goa records highest RevPAR in Q1 2021, Bengaluru saw sharpest decline: JLL

Goa recorded highest RevPAR in absolute terms, despite the single digit decline of RevPAR by 1.1% in Q1 2021 as compared to Q1 2020, revealed JLL’s Hotel Momentum India (HMI) Q1 2021. The report highlighted that Bengaluru saw the sharpest decline of 60.6% in RevPAR compared to the same period of the previous year. High demand from domestic leisure travelers make Goa the fastest recovering market in absolute RevPAR terms

Read More »Occupancy in Indian cities at par with Asian counterparts

HVS ANAROCK’s latest report titled ‘Room for Growth’ states that the three Indian cities (Bengaluru, Delhi-NCR and Mumbai), though still underpenetrated, have been performing at par with other Asian cities, especially on the occupancy front. As for RevPAR, Bengaluru is in the same range as Beijing and Shanghai.

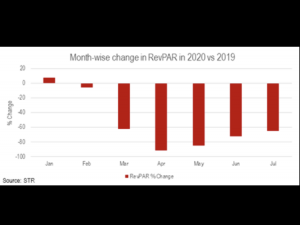

Read More »RevPAR in Delhi down 44% till July

Delhi has seen significant decline in Revenue Per Available Room (RevPAR) YTD July 2020, declining 44.3% over the same period in the previous year, according to JLL India Hotels and Hospitality Group’s latest note.

Read More »RevPAR in Bengaluru down by 59%: JLL

According to a JLL report, Bengaluru’s hotel sector performance declined 59% in RevPAR in YTD July 2020 (YoY) but is expected to bottom out in Q4 2020 as domestic travel gains momentum. Occupancy was also down 53% YTD July (YoY).

Read More »Kochi hotels lead in RevPAR: HVS ANAROCK

HVS ANAROCK’S latest monthly newsletter titled ‘Hotels & Hospitality Overview India’ reveals that Kochi was the top performing market in India in June with negative growth in RevPAR at 50.3 per cent, followed by New Delhi at 72.4 per cent. Bengaluru and Goa were the lowest performers for the month of June 2020.

Read More » Tourism Breaking News

Tourism Breaking News