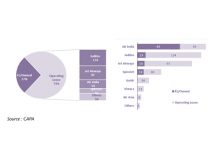

According to FICCI’s recent report titled ‘Opportunities and Financing Outlook for Aviation Sector’, there will be a huge number of aircraft deliveries in India in the next few years. The report quoted a CAPA study, which estimated that out of 400 aircraft deliveries by FY22 to Indian carriers, 70-80 per cent of them will be either on direct lease or sale and leaseback transactions.

According to FICCI’s recent report titled ‘Opportunities and Financing Outlook for Aviation Sector’, there will be a huge number of aircraft deliveries in India in the next few years. The report quoted a CAPA study, which estimated that out of 400 aircraft deliveries by FY22 to Indian carriers, 70-80 per cent of them will be either on direct lease or sale and leaseback transactions.

To fulfil growing demand, the Government has envisaged huge capex of around US$ 15.5 billion towards development of Greenfield airports, expansion of Brownfield airports, fleet addition & maintenance by Indian Carriers and strengthening ancillary services like skill development, MRO, Cargo handling, amongst others in the value chain. This development plan by airports and airlines requires strong support from Banks, Lessors, Private Equity Firms and other Financial Institutions to cater their funding requirement.

Breaking News

- PDMF 2025 to kick off from 1 Dec in Thailand’s Chiang Rai, to spotlight wellness, culture & destination reinvention

- MPTB gets ‘Best State – Tourism Board’ recognition at India Travel Awards

- Visa-free travel could unlock new destinations for 91 % Indian tourists: Agoda

- Policy changes result in shortage of trained guides, TGFI urges station-specific training

- Robust travel demand fuels IHCL’s domestic RevPAR up 9% in H1, global 11%: Parveen Chander Kumar

- Vivek Aggarwal gets additional charge as Tourism Secretary

- Me’gong Festival 2025 to Shine with Global Icons in Garo Hills

- The all new Oberoi Rajgarh Palace opens in Khajuraho, Madhya Pradesh

- GRT Hotels hosts ‘GReaT Conversations’, an all-women panel on emerging travel trends & evolving guest behaviour

- Rail Europe hosts fam trip for key India and GCC partners

- Bengal becomes India’s second most-preferred foreign tourist destination, posts 14.8% growth in 2024

Tourism Breaking News

Tourism Breaking News