FTAs from India’s top 10 markets increased at a CAGR of 5.5% during 2008–2018, reveals CAPA India. China’s rank improved to 7th in 2018 from 10th in 2017. FTAs from Russia registered the highest CAGR of 11.2% during the last 10 years, followed by China (11.2%), Malaysia (10.7%) and Australia (9.0%). In 2018, Sri Lanka (16.5%) and c(14.0%) were the only two source markets (amongst the top 10) that saw double-digit year-on-year growth.

Read More »India is highly dependent on long haul source markets for tourists

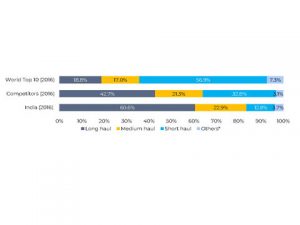

The majority of India’s inbound tourists (60.6 per cent) are from long haul source markets, that is, greater than six hours’ flights, according to a latest report by CAPA India research and analysis. Most of the world’s largest tourism destinations receive the largest proportion of their visitors from short and medium haul markets. This distance puts India at a strategic disadvantage in terms of cost and ease of access and increases the number of potential destinations it competes with that lie within a similar arc. It is relatively less well-placed to attract travellers planning short, spontaneous breaks.

Read More »India’s GDP to reach USD492 billion in 2028: WTTC

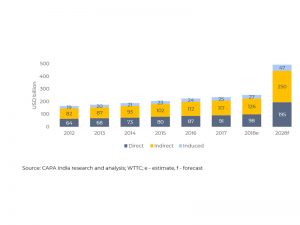

WTTC forecasts the total contribution of Travel and Tourism to India’s GDP will more than double from USD234 billion in 2017 to USD492.2 billion in 2028. Besides the direct contribution of travel and tourism to national GDP, the sector’s induced contribution increased 6.6 per cent per annum between 2012 and 2017, while indirect contribution grew at 7.5 per cent during the period, CAPA India’s Inbound Tourism Report reveals. The sector can support job opportunities in rural opportunities in rural communities — where they are needed the most, especially in developing countries like India. Additionally, for developing economies, travel services were consistently the lead contributer towards service exports between 2006 to 2016.

Read More »Indians mostly spend USD75-150 per day per room on overseas holidays

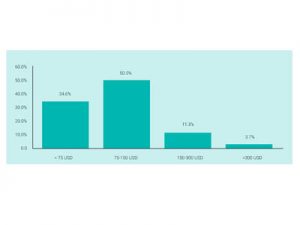

More than 50 per cent of Indian travellers budgeted USD75-150 per room per night for leisure travel, reports a study by CAPA India and Expedia titled ‘The Inflection Point for Indian Outbound Travel’. Hotels have been the standard option for the Indian traveller in the past, however, travellers are now exploring other accommodation options, with 38% of survey respondents having rented a villa or apartment while travelling overseas. This has been made more accessible by online platforms such as Airbnb and others, which offer homestays. Traditionally at short-haul destinations, Indian travellers spend one-third of their holiday budget on accommodation. Indians visiting Singapore spent around 35% of their trip cost on accommodation, compared to Chinese and Indonesians who spent only about 18% in 2015. For medium to long-haul destinations, the spend on accommodation can increase to up to half of the total trip budget. Indians visiting Mauritius in 2016, spent around 56% of expenses on accommodation while those visiting Switzerland spent around 48% of their budget on accommodation. International leisure travellers from India are drawn mostly from high and upper-middle income economic segments. They are used to a certain standard of living and expect similar conditions and conveniences when travelling. Given the high quality of hotels in India, there is an assumption that equivalent levels of luxury and service will be available overseas, which is not always the case. Leading hotel chains have shared that they find it difficult to replicate their customer proposition at overseas destinations because of the much higher cost of labour and different service cultures. This can result in expectations being disappointed.

Read More »Narrowbodies account for ¾ of India’s current aircraft fleet

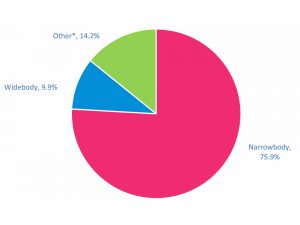

Narrowbodies account for ¾ of the total current fleet, with widebodies contributing a further 10 per cent, as per a recent ‘Project Rupee Raftaar’ report by the Ministry of Civil Aviation. The remainder consists primarily of turboprops and regional jet aircraft. Reflecting the relative size of the domestic and international markets, the composition of the current inservice fleet is heavily tilted towards narrowbody aircraft. India, which has the third-largest aircraft order book (including wide-body and narrow-body aircraft) after the US and China, now has more narrow-body orders than China, CAPA India said in one of its reports.

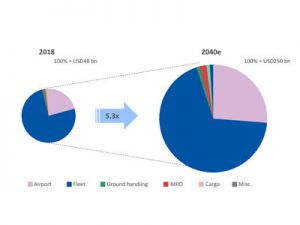

Read More »Indian aviation to attract an investment of $250 billion over the next 20 years

The Indian civil aviation industry is set to attract an additional $250 billion by 2040, according to a latest report by CAPA India. The industry has attracted cumulative investments of $48 billion during the last 15 years. Over 90 per cent of incremental investments are expected on aircraft acquisition and airport development. By FY2040, India is expected to see its fleet increase by around 2500 aircraft and the construction of more than 50 new airports. Combined with investment in ancillary services such as ground handling, MRO and training, Indian aviation will require up over USD250 billion of capital expenditure over this period.

Read More » Tourism Breaking News

Tourism Breaking News