As per HVS Anarock April 2025 report, Indian hotels’ occupancy growth trends in March 2025 showed a mixed pattern across key Indian markets, with Bengaluru, Chennai and Gurugram emerging as the top gainers. However, strong year-on-year Average Room Rate (ARR) growth (₹9,000–₹9,200) was recorded with Hyderabad at the top.

Read More »Infra status key to hospitality sector’s growth, enables long-term financing: Mandeep Lamba

Mandeep Lamba, President, South Asia, HVS, stressed the need for infrastructure status in the hospitality industry. He said “Infrastructure status is the first requirement for hospitality, as it enables access to long-term financing. Hotels are a highly capital-intensive business.” This move would drive investment and sectoral growth.

Read More »Kochi hotels lead in RevPAR: HVS ANAROCK

HVS ANAROCK’S latest monthly newsletter titled ‘Hotels & Hospitality Overview India’ reveals that Kochi was the top performing market in India in June with negative growth in RevPAR at 50.3 per cent, followed by New Delhi at 72.4 per cent. Bengaluru and Goa were the lowest performers for the month of June 2020.

Read More »Despite low occupancy, 71% of GMs will not discount rates by over 20%

In order to understand the pulse of the industry amidst these unprecedented times, HVS ANAROCK conducted an anonymous online survey with Hotel General Managers (GMs) in the last week of April 2020. The survey revealed that despite expecting low occupancies, over 71% of the GMs will not discount their rates by more than 20%. Over 42% GMs believe that occupancy would be close to or higher than 50%, while 46% of the GMs believe that occupancy will remain below 40%. The survey revealed that most GMs expect demand to pick up by Q4 2020.

Read More »Hotel sector to see a decline in revenue by INR 90,000 cr in 2020: HVS ANAROCK

The Indian hotels sector has come to a standstill in the last one month, with most of the hotels partially or completely shut. HVS has revised previous estimates of the overall revenue loss that the industry will face in 2020. The overall revenue of the Indian hotels sector is expected to decline by approximately INR 90,000 cr in 2020, reflecting an erosion of 57% compared to last year. RevPARs in the organized segment are expected to decline by approximately 58%. Occupancy is expected to decline by 31.6 per cent. In the organised sector the loss is expected to be INR 40,309 cr; in the semi organised sector the loss is expected to be INR 8,379 cr and in the unorganised sector it is expected to be INR 41,126 cr. The source for the above data is HVS Research as on 17 April 2020. The industry has not witnessed such an unprecedented decline in RevPARs in the last 2 decades, since HVS has been recording this data. The unorganised segment, which is 10 times the size of the organized segment, is also anticipated to witness a similar quantum of decline. COVID-19 is a disruption that nobody anticipated, but it is now time to use the learnings from this disruption and plan for the new realities beyond COVD-19

Read More »Indian hotel sector’s revenue to decline by almost $10 billion in 2020: HVS

According to an HVS report, the overall revenue of the Indian hotel sector is set to decline by anywhere between $8.85 billion and $10 billion this year, reflecting an erosion of 39-45 per cent compared to the previous year. The report also shows that besides actual business loss, hotel owners will also incur losses due to fixed operating expenses, debt repayments, interest payments and several other compliances required to be undertaken. It is important to note that the magnitude of the impact can change drastically if the outbreak is not contained immediately. In such an event, these scenarios will turn invalid.

Read More »6.5% decrease in hotel occupancy in Dec 2019 as compared to Nov 2019 across India: HVS

Hotel performance in India was subdued in December 2019 due to temporary softening of demand, reveals Hotels & Hospitality Overview India (January 2020) by HVS. December recorded an ADR of Rs. 6697.8 in top 13 markets in India recording a Month-on-Month (M-o-M) decline of -1.10 % and Year-on-Year (Y-o-Y) decrease of 0.63%. The occupancy was 70.5% with a 6.51% decline M-o-M and 0.35% decrease Y-o-Y. The RevPAR in December was Rs 4719.1, recording a -7.54 decrease M-o-M and 0.98% Y-o-Y.

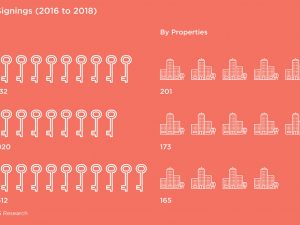

Read More »2018 saw around 201 signing of branded hotel properties

According to the HVS ANAROCK India Hospitality Review 2018, revealed that over 2016 and 2017, new hotel signings in the country remained in the region of ~170 signings, but in 2018, the industry set a record with signing of 201 hotels containing 19,128 keys, signalling a strong growth in investor sentiment. The branded hotel sector comprises of a collection of around 50 hotel companies, each actively competing to find mind share with hotel owners & developers, who are further looking to either convert or build a new property.

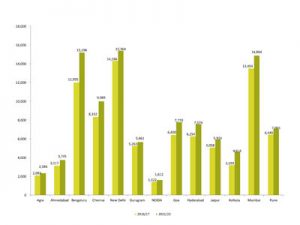

Read More »All major Indian markets witness an increase in RevPAR: HVS

All major markets in terms of hotel performance have witnessed an increase in RevPAR except for Agra, according to HVS’ Trends & Opportunities survey. Noida (including Greater Noida) saw the highest year-on-year growth in RevPAR (16.0%), followed by Hyderabad (11.4%) and Ahmedabad (10.7%). Mumbai continues to lead in terms of both occupancy (74.2%) and average rate (`7,693) for the third year running. Noida displayed the lowest occupancy (56.9%) and Ahmedabad, the lowest average rate (Rs 3,840). All 13 hotel markets depicted an increase in occupancy leaving Pune (-0.7%), even as some markets saw a lower growth (Bengaluru and Mumbai at 0.4% and 0.6%, respectively) compared to others (Ahmedabad and Noida at 12.0% and 11.7%, respectively). In 2016-17, only two cities showed a decline in average rates – Agra, which witnessed a steep decline of 8.9% over 2015/16 and, Ahmedabad, which witnessed a minor decline of 1.1%. Goa registered the highest year-on-year increase of 7.3% in average rate, followed by Pune (5.7%).

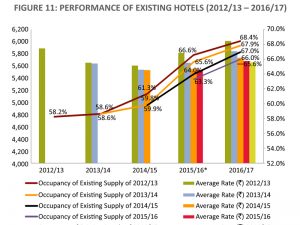

Read More »Occupancy for all branded hotels in India remains 65.6 % in 2016-17: HVS

The nationwide occupancy for all branded hotels was 65.6 per cent in 2016-17 and the hotels that have existed since 2012/13 achieved 68.4% occupancy last year, according to a report by HVS Global Hospitality Services. Similarly, hotels that have been operating since 2013/14 clocked 67.9% occupancy in 2016/17. On the average rate front, while India’s ARR was `5,658 in 2016/17, for hotels in existence since 2012/13, the ARR last year was more than `6,000.

Read More » Tourism Breaking News

Tourism Breaking News