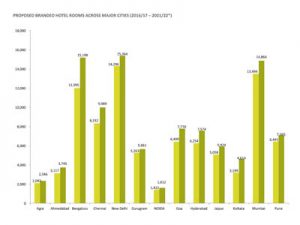

Mumbai is leading in terms of hotel occupancy (74.2%) as per a report by HVS Global Hospitality Services. According to the report as expected in the second year of the up-cycle, all major markets tracked witnessed an increase in Revenue per available room (RevPAR) except for Agra. Interesting to note, Noida saw the highest year-on-year growth in RevPAR (16.0 %), followed by Hyderabad (11.4%) and Ahmedabad (10.7%). Noida displayed the lowest occupancy (56.9%) and Ahmedabad, the lowest average rate (3,840), the study said. All 13 hotel markets depicted an increase in occupancy leaving Pune (-0.7%), even as some markets saw a lower growth (Bengaluru and Mumbai at 0.4% and 0.6%, respectively) compared to others (Ahmedabad and Noida at 12.0% and 11.7%, respectively). In 2016/17, only two cities showed a decline in average rates – Agra, which witnessed a steep decline of 8.9% over 2015/16 and, Ahmedabad, which witnessed a minor decline of 1.1%. Goa registered the highest yearon-year increase of 7.3% in average rate, followed by Pune (5.7%).

Read More »New opened hotels in India averaged 45.9% occupancy: Report

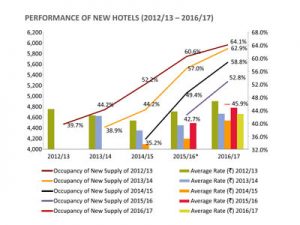

Hotels that opened in 2015-16 in India averaged 42.7 per cent and, new openings of 2016-17 averaged 45.9 per cent occupancy in their very first year, according to a report by HVS Global Hospitality Services. Similarly, while first year ARRs were successively lower than their preceding years from 2012-13 to 2014-15, the ARR for hotels that opened in 2015-16 and 2016-17 have seen an increase in comparison to their preceding year, the report said. Both these figures, coupled with the demand-supply outlook for the next sixty-months, further corroborate our view that most markets in India are at a point where both occupancy and ARRs can substantially improve. The question is whether the sector’s stakeholders will truly manage to capitalise on the evident opportunity, or do we still need to live by the adage, the report said.

Read More » Tourism Breaking News

Tourism Breaking News