Around 13 companies are sitting with approvals from (SEBI) for their Initial Public Offering (IPOs), which could result in over Rs 13,000 worth of public issues into the primary market. These companies include Go Air, Pradeep Phosphates, and Fincare Small Finance Bank, which could soon come with the public issues, revealed Axis Capital. Within this financial year, around 24 companies have successfully made their stock exchange debuts.

Read More »Govt to sell 20% stake in IRCTC, Offer for Sale open

The government has proposed to sell up to 20% of its stake in IRCTC through an Offer for Sale (OFS) which opens for subscription on Thursday. “Offer for Sale in IRCTC opens tomorrow for Non Retail investors. Day 2 for retail investors. The government would divest 15 percent equity with a 5 percent green shoe option,” said Tuhin Kanta Pandey, Secretary, Department of Investment and Public Asset Management (DIPAM) in a tweet. As of September 30, the government had held an 87.40 stake in IRCTC which went public last year. To meet SEBI’s public holding norm, the government has to lower its stake in the company to 75%.

Read More »TCI proposes to raise over Rs. 600 cr via dilution of stake in Quess Corp

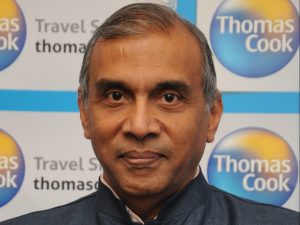

Thomas Cook (India) has obtained Board approval to divest a 5.42 per cent stake in its subsidiary Quess Corp, to bring its shareholding to 51.56 per cent, thereby proposing to raise funds of over Rs 600 cr. through an Offer for Sale (OFS) process as prescribed by SEBI. This is in keeping with SEBI regulations that require promoters to bring down their stake to 75 per cent and post dilution, the promoter shareholding in Quess Corp (that of Thomas Cook India and Ajit Isaac, CMD & CEO, Quess Corp.) would be 75.38 per cent. Fairfax Financial Holdings, through the Thomas Cook India Group, is committed to maintaining a controlling stake in Quess Corp. Madhavan Menon, Chairman & Managing Director, Thomas Cook India Group, said, “At the Thomas Cook India Group we are committed to holding a controlling stake in our subsidiary Quess Corp. Our proposed dilution of a portion of our stake in Quess Corp is hence intended to comply with SEBI regulations. Our aim is to retire our long term debt and improve profitability; simultaneously increase our cash reserves, enabling us to effectively leverage opportune investments as and when they arise.” The initiative is also aimed at retiring Thomas Cook India’s long term debt, thus bringing down the company’s financial costs and improving profitability and liquidity at both a standalone and group level.

Read More » Tourism Breaking News

Tourism Breaking News