Nirmala Sitharaman, Finance Minister, GoI, announced “Govt to increase TCS on remittances under RBI’s Liberalised remittance scheme from ₹7 lakh to ₹10 lakh. She also said, “In the budget of July 2024, the delay of the payments of the TDS up to the due date of filing statements was decriminalised; I propose the same from the TCS provisions as well.” Number of rates and thresholds above which TDS is deducted to be reduced Limit for tax deduction on interest for senior citizens to be doubled from ₹50,000 to? 1 lakh Annual limit for TDS on rent to be increased from ₹2.40 lakh to ₹6 lakh Threshold to collect tax at source on remittances under RBI’s Liberalized Remittance Scheme to be raised from ₹7 lakh to ₹10 lakh

Read More »TAAI to launch tax cell to help support its members in areas of GST & TCS; efforts underway to strengthen ties with airlines: Sunil Kumar

Sunil Kumar, President, Travel Agents Association of India (TAAI), said, “We will be launching a tax cell which would be a kind of a handholding for our members on matters in the areas of GST and TCS. A committee has been formed and is already working towards launching this cell. Our efforts to build bridges and deepen relations with the airlines are also underway.”

Read More »Union Budget doesn’t fully meet high expectations set by previous promises: PP Khanna

Giving his reaction to the Union Budget announced today, PP Khanna, President, ADTOI, said, “The budget was expected to be a comprehensive roadmap for the next five years but appears to lack substantial long-term strategies. Specific sectors, such as tourism, received attention, but the initiatives may seem insufficient in scope.” Commenting further, he said, “The government has implemented GST, which has reduced the compliance burden on trade and industry by unifying the highly fragmented indirect tax regime in India. The tax base of GST has more than doubled, and the average monthly gross GST collection has almost doubled to ₹1.66 lakh crore. On the other hand, no specific information on TCS in the tourism industry is available. The tourism industry has been impacted by the introduction of GST and TCS, with some tour operators and travel agencies facing challenges in complying with the new tax regime. However, the government has taken steps to simplify the tax process and reduce the compliance burden on businesses. The general sentiment is that the budget does not fully meet the high expectations set by previous promises.”

Read More »‘TCS is a fair issue raised by outbound sector, we will take it up with Ministry of Finance’: Suman Billa

Suman Billa, Additional Secretary, Tourism, has said that TCS is a fair point raised by outbound sector, because people who are doing business in India are getting disincentivised and who travel abroad can make the payment and obviate the entire necessity of paying the tax. “We will be taking it up with the Ministry of Finance,” he added.

Read More »5% TCS on overseas packages up to RS 7 lakh, 20% thereafter wef Oct 1, 2023

Ministry of Finance has announced that there will be no change in the rate of TCS for all purposes under LRS and for overseas travel tour packages, regardless of the mode of payment, for amounts up to Rs. 7 lahks per individual per annum. For the purchase of overseas tour program package under Clause (ii) of Sub-section (1G), the TCS shall continue to apply at the rate of 5% for the first Rs 7 lakhs per individual per annum; the 20% rate will only apply for expenditure above this limit. Increased TCS rates to apply from 1st October 2023

Read More »TCS increase will hamper both our business and government revenue: Riaz Munshi

Riaz Munshi, President, OTOAI, has said that the TCS being increased to 20% will hamper our business and at the same time there is going to be a huge deficiency in government revenue as people would prefer to either book through foreign tour operators or foreign OTAs to save GST and TCS both. “At present as well, outbound tour operators and government of India is losing revenue on the same grounds,” he added.

Read More »TCS for overseas tour packages above ₹50 lakh increased from 5% to 20% in Budget 2023-24

In the Union Budget 2023, it was announced that the government has increased Tax Collection at Source (TCS) for overseas packages from 5%to 20%. Riaz Munshi, President, OTOAI, says that instead of reducing the TCS, it has been increased and it will hamper the business. Rajeev Sabharwal (CA), Chief Executive, Gaurav Travels, says outbound industry should oppose this move.

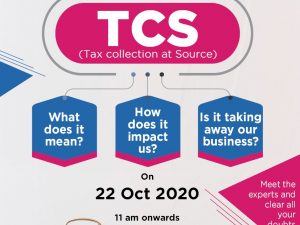

Read More »‘Understanding TCS’ webinar on Thu, 22nd October

Global Panorama Showcase (GPS) and TravTalk is set to bust all myths regarding Tax Collected at Source (TCS) with the webinar ‘Understanding TCS’, which will be held on Thursday October 22, at 11 am. The webinar would allow travel professionals to understand what TCS is, how it will impact them and if it is taking away their business. The experts will clear all such doubts. To register, contact Jaspreet Kaur at 9650196532 or Jaspreet.kaur@ddppl.com.

Read More »Finance ministry defers implementation of TCS amendments till 1st October

In a statement, the Outbound Tour Operators Association of India (OTOAI) said that the Ministry of Finance has deferred the implementation of the TCS amendments proposed in the Union Budget 2020-21 till 1st October 2020. Making amendments in the Finance Bill 2020 before getting in passed in the Lok Sabha, the Finance Minister decided to defer the implementation of the much talked about TCS provisions to charge 5 per cent income tax on the sale of overseas tour packages and foreign exchange remittances from the buyer by the virtue of Section 206C under the Income Tax Act. OTOAI further said it will continue this dialogue and strive for the complete rollback of TCS altogether by highlighting its adverse impact on Indian outbound operators and how it would render us uncompetitive given the competitive landscape which also includes foreign players. OTOAI will keep addressing various issues concerning overseas travel with the respective ministries for the benefit of the outbound tour operators and its members.

Read More » Tourism Breaking News

Tourism Breaking News