Kapil Kaul, CEO, CAPA India, has suggested that leadership and governance will be essential in making structural changes in tourism. “Since tourism is going to be very dynamic going forward, we may require a specialised Tourism Administrative Service, which has policymakers on the lines of IAS. Since tourism covers so many aspects, unless we have policymakers who specialise in tourism, institutional foundations can’t be fed. There is also a need for a legally empowered tourism council on the lines of GST council, which can comprise of union minister of tourism, state tourism minister, secretaries and all other experts whose job should only be focused on policy and regulatory effectiveness, competitiveness, ease of doing business, financing, education and training,” he recommended.

Read More »CAPA India report says India could still have 250-300 aircraft surplus by March 2021

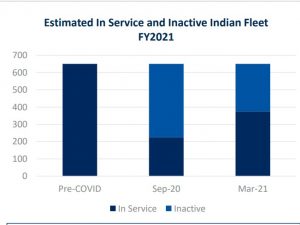

India’s airlines could still have 250-300 surplus aircraft by March 2021, and could therefore be headed for an unprecedented consolidated loss of USD 4-4.5 billion in FY2021. Approximately 400-450 aircraft were grounded by end of Q2 2020. This figure is expected to improve slightly with 250-300 aircraft being grounded by end of Q4.

Read More »Indian airlines need additional funding of USD 3-3.5bn in FY21

CAPA India in its webinar on ‘Financing Indian Aviation in the Post COVID-19 era’ projected that Indian carriers will require additional funding of INR 200-250 Billion in FYY2021 to bridge the gap between revenue and expenditure. According to CAPA India, the aviation industry in the country needs massive recapitalisation and urgently. Delays will further diminish the already compromised chances of survival. Industry and government collaboration is essential for survival and revival. Industry cannot navigate the crisis alone.

Read More »Funding options for airlines: CAPA India

According to a research and analysis conducted by CAPA India recently, all funding options need to be on the table and fully explored by the Indian airlines to identify the most appropriate and viable for implementation. It includes the element of Original Equipment Manufacturing compensation. The industry’s financial challenges will become increasingly apparent from September-October. Promoters, bankers, private equity and the government are all unwilling to provide support given demand risk and uncertainty.

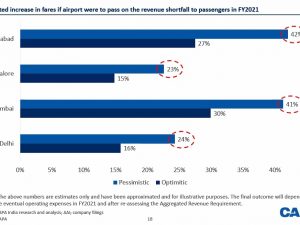

Read More »Private airport to see revenue shortfall

According to CAPA India, four largest private airports in Delhi, Mumbai, Bengaluru and Hyderabad are expected to see a revenue shortfall of Rs 5,700 to Rs 6,600 crores in FY2021 because of COVID-19. The final outcome will depend upon the eventual operating expenses.

Read More »Airports need to attract more non-stop, long-haul services: CAPA India

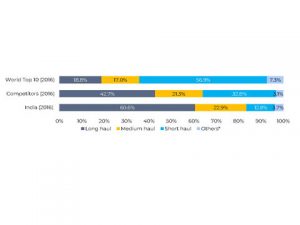

In its webinar, ‘Reinventing the Airport Business Model in India’, CAPA India said that the current crisis must force a re-think and re-invention of the airport business model over the next five years. To increase aero and non-aero revenue, airports need to attract more non-stop, long-haul and wide-body services. Post-COVID, passengers may prefer non-stop flights instead of flights via a hub. CAPA India also talked about the need to reinvent the approach to route development, which should be more holistic and include forward bookings, travel search trends, consumer survey and travel trade research.

Read More »Government and industry need to collaborate to rethink & redesign aviation: CAPA India

`In its latest analysis on the impact of COVID-19 on the aviation industry, CAPA India has said that the government and industry will need to collaborate to rethink and redesign aviation sector to emerge from the crisis and move towards a sustainable future. The report explains, “The current crisis should be used to initiate structural changes for the long-term viability of the sector. The industry will need to make some hard choices. Airlines will need to restructure their businesses to become leaner and reduce costs, whilst also increasing the strategic deployment of technology and analytics to enhance revenue and improve efficiency.”

Read More »150 aircraft, including almost all of the international fleet, could be grounded soon: CAPA India

CAPA India’s preliminary estimates for the near-term impact on the Indian industry states that as a result of the significant reduction in flying, Indian carriers may initially ground around 150 aircraft (including almost all of the international fleet), with this number expected to increase as more domestic operations are curtailed over the coming weeks. Based on the latest cancellations, international capacity is currently estimated to be down by 60-70 per cent year-on-year, although the situation is evolving on a daily basis. India has banned entry by all foreign nationals (with some very limited exceptions) until at least April 15, 2020. Foreigners account for around 25 per cent of international air travellers to/from India. However, India has also blocked the entry of its own nationals from the European Union and several other countries, and has advised its citizens not to travel overseas. If the decline in traffic continues to be severe, the majority of the fleet could be grounded by April.

Read More »India’s top FTA markets grow at a CAGR of 5.5% during 2008–2018: CAPA India

FTAs from India’s top 10 markets increased at a CAGR of 5.5% during 2008–2018, reveals CAPA India. China’s rank improved to 7th in 2018 from 10th in 2017. FTAs from Russia registered the highest CAGR of 11.2% during the last 10 years, followed by China (11.2%), Malaysia (10.7%) and Australia (9.0%). In 2018, Sri Lanka (16.5%) and c(14.0%) were the only two source markets (amongst the top 10) that saw double-digit year-on-year growth.

Read More »India is highly dependent on long haul source markets for tourists

The majority of India’s inbound tourists (60.6 per cent) are from long haul source markets, that is, greater than six hours’ flights, according to a latest report by CAPA India research and analysis. Most of the world’s largest tourism destinations receive the largest proportion of their visitors from short and medium haul markets. This distance puts India at a strategic disadvantage in terms of cost and ease of access and increases the number of potential destinations it competes with that lie within a similar arc. It is relatively less well-placed to attract travellers planning short, spontaneous breaks.

Read More » Tourism Breaking News

Tourism Breaking News