About 81 per cent of commercial aircraft in India are leased, compared with 53 per cent globally, according to a recent report by Centre for Asia Pacific Aviation (CAPA) titled ‘Aircraft leasing in India: Opportunity knocks for an Indian lessor’. Leased aircraft take a high share of all operators’ fleets in India. There are 652 commercial aircraft with operators in India at 17-Oct-2018 (including 34 in storage), according to the CAPA Fleet Database. Of these, 531 aircraft are leased, which is 81% of the total. This compares with a leased aircraft share of 52% in Asia overall and 53% globally. Indian airlines’ leasing dependency reflects their relative youth and/or financial fragility. By comparison with other parts of the world, Indian operators rely much more heavily on leased aircraft. In Asia as a whole, leased aircraft account for 52% of all aircraft in service and in storage. Globally, the share is 53%.

Read More »Indian airlines to induct 124-130 aircraft in FY 2018-19

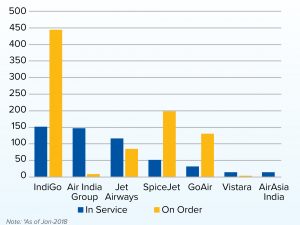

India’s airlines are expected to induct an unprecedented 124-130 aircraft in FY2018/2019, with IndiGo accounting for close to half of this number, according to CAPA estimates on South Asia Aviation Outlook 2018. All Indian LCCs, except AirAsia India, are profitable, and are expected to report a combined profit of USD450 million to USD500 million. In contrast, FSCs are projected to lose USD825 million to USD850 million, although most of this is accounted for by Air India. Vistara is also loss making, while Jet Airways will either report a modest profit or be closer to break even. In 2018, Jet Airways is expected to place an additional order for 75 narrowbodies and to make a decision on its wide body plans, including the 10 787s on order that it has repeatedly deferred. Vistara will likely order 50 narrowbodies, together with a modest initial order for less than 10 widebodies, which may increase later. IndiGo and SpiceJet could place orders to support international expansion, including widebodies, and we do not rule out the possibility of a turboprop order by GoAir. Air India’s fleet plans are currently on hold pending its proposed privatisation.

Read More »Rashmi Verma highlights 3-pronged strategy at PATA India’s Tourism PowerHouse

Highlighting areas where the Ministry of Tourism will spend more on promotional activities, Rashmi Verma, Secretary, Tourism and Chairman, PATA India Chapter, spoke of the Ministry’s three-pronged strategy at PATA India’s first-ever Tourism PowerHouse held at The Park, New Delhi. “We have a three-pronged strategy for increasing inflow to the country. First, we have G2G interactions; 16 MOUs have been signed in this regard. The second is promoting through B2B interactions, where we have employed a number of methods. We have been participating in all major world tourism marts that give us an excellent opportunity. Apart from that, we have roadshows in which we lead a delegation of the industry and give a platform to them for further networking. This year, we’re taking things a step forward and organising India Travel Mart in September, which is likely to get 250 buyers from around the world. The third part of the strategy is more B2C interactions. How we reach out to consumers is the third aspect of our strategy,” she elaborated.

Read More »IndiGo expected to get aggressive in 2018-19

Sharing CAPA’s forecast for 2018-19 during the Annual CAPA India Aviation Summit 2018 held in Mumbai, Kapil Kaul, CEO & Director—South Asia, CAPA revealed some key expectations from IndiGo. He said, “IndiGo’s long-haul expansion will be aggressive and akin to a full service carrier. It will dominate the low cost carrier market which may cause some sort of friction between airlines. IndiGo may also build cross-border joint ventures but it depends on what happens with its plans for Air India, since IndiGo is one of the six possible bidders for the national carrier. IndiGo may also look at franchise as part of its cross-border plans.” Kaul added that while there might be four Indian carriers to bid for investing in Air India, there might also be two non-aviation entities and huge corporates.

Read More »CAPA India Summit to be held on Jan 30-31, 2018 in Mumbai

Centre for Asia Pacific Aviation (CAPA) India has announced the dates for its annual meeting of aviation industry leaders with an interest in India. Now in its 14th year, the CAPA India Summit will be on January 30-31, 2018, in Mumbai. This year CAPA has added a third day dedicated to airports and airspace opportunities. Titled CAPA India Airport & Airspace Summit, this will be held on 1 February, 2018. Part of the agenda is announcement of a series of strategic research reports by CAPA, including its annual outlook for Indian aviation in 2018-19. The association expects participation from every airline and airport operator in the country and an audience of close to 250 critical decision-makers from airlines, airports, investors and financiers, manufacturers and lessors, suppliers, travel companies and tourism boards.

Read More »Restrictions impede achieving true potential of aviation: CAPA

India’s status as the fastest growing aviation market could be hampered because of infrastructure planning adequacies, a fast emerging shortage of skills, flawed policy initiatives, and weak regulatory oversight, suggests an extract from CAPA’s India Aviation Outlook 2017/18. CAPA estimates that India’s airlines reported a combined profit of $122 million in FY2016, the first time in a decade. Lower fuel prices combined with modest capacity growth and strengthening economic fundamentals were largely responsible for surging traffic and an improvement in airline financials in FY2016. Domestic traffic was up 21.2 per cent while international grew by a more modest 7.7 per cent. India’s domestic market is on track to surpass 100 million passengers in FY2017. After a strong FY2016, traffic growth has accelerated further in FY2017, with India likely to overtake Japan this year to become the world’s third largest domestic market behind the USA and China. However, the report states that risks are also heightened. The next financial year is expected to be the third consecutive year of domestic growth above 20 per cent. Growth could be as high as 25 per cent but may be tempered by 3-5 percentage points because of the impact of demonetisation. The introduction of the GST next year may possibly also have a short-term negative impact on economic growth for a couple of years until more positive results emerge. International traffic is expected to expand at 10-12 per cent in FY2017 and FY2018, but bilateral restrictions preclude achieving true potential, Traffic growth is being stimulated above its underlying demand as a result of excess capacity and competitive fares. The downward pressure on yields, combined with cost creep, is expected to push the consolidated industry …

Read More » Tourism Breaking News

Tourism Breaking News