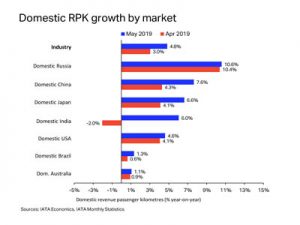

The recently released global passenger traffic results for May by The International Air Transport Association (IATA), revealed that after a fall in domestic RPKs in April (down 2.0 per cent YoY), following the demise of Jet Airways, growth in the India market rebounded sharply in May, with RPKs now an even 6.0 per cent higher than a year ago. While it will take some time for the market to adjust to the recent shock, the longer-term outlook for domestic India traffic remains positive.

Read More »Domestic aviation growth dips sharply in India to 3.1% year-on-year: IATA

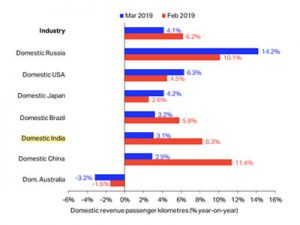

Year-on-year RPK growth slowed substantially in the domestic India market in March 2019, from 8.3 per cent in February, to 3.1 per cent currently, according to International Air Transport Association (IATA). Over the past five years, annual growth has averaged a double-digit pace close to 20 per cent. In large part, the slowdown reflects the disruption of flight operation for Jet Airways, including a number of flight cancellations, as well as construction works at Mumbai airport which also interrupted operations. Rising airfares in recent months are also likely to have weighed upon passenger demand.

Read More »India records over 20% growth in the number of new air routes: IATA

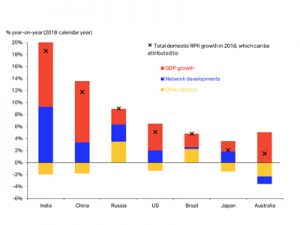

The growth of more than 20 per cent in the number of new routes in India provided a sizeable boost to passenger demand in the market, according to a latest report by International Air Transport Association (IATA). The surging number of international flyers is drawing airlines to new air routes in India. The increase in international air traffic from India and a focus on business and leisure travellers has prompted not only foreign airlines such as Air Italy and NokScoot to launch new routes to destinations in the country but has also got several Indian carriers including Jet Airways and IndiGo to start operations on foreign routes. Although the combination of GDP and network developments explain more than three quarters of the variation in domestic revenue passenger kilometers (RPK) growth rates over time, other factors such as tourism attractiveness, availability of travel alternatives, trade flows and demographics account for the residual growth in traffic in the country. India has become the third largest domestic aviation market in the world and is expected to overtake the UK to become the third largest air passenger market by 2025, states a report by India Brand Equity Foundation (IBEF). The report reveals that by 2036, India is estimated to have 480 million flyers, which will be more than that of Japan (just under 225 million) and Germany (just over 200 million) together.

Read More »India becomes fastest growing domestic aviation market 4th year in a row: IATA

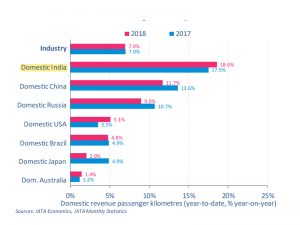

The domestic aviation market in India has registered the fastest growth for the fourth year in a row in 2018, according to a recent report by International Air Transport Association (IATA). The year-end aviation data analysis by IATA revealed, “The India domestic market recorded the fastest full-year domestic growth rate for the fourth year in a row (18.6 per cent), followed by China (11.7 per cent).” In fact, India recorded its 50th consecutive month of double-digit annual growth in October. Other than India and China, Russia (9 per cent), USA (5.1 per cent) and Brazil (4.8 per cent) were among the top five fastest growing domestic air travel markets. According to the IATA report, globally, revenue passenger kilometers (RPKs) rose by 6.5 per cent in 2018, slower than the 8 per cent growth registered in 2017.

Read More »India records fastest domestic aviation growth of 18.6 per cent: IATA

The India domestic market posted the fastest full year domestic growth rate for the fourth year in a row (18.6 per cent), according to an International Air Transport Association (IATA) report. Domestic demand in India was underpinned by a robust economic expansion as well as by increasing number of domestic pairs. The country recorded its 50th consecutive month of double-digit annual growth in October. .“While globally, domestic air travel climbed 7 per cent last year, which remained unchanged from the rate in 2017. All markets showed annual growth, led by India and China, which both posted double-digit annual increases,” the report added.

Read More »India’s domestic passenger load factor exceeded 90% for the first time ever in February 2018

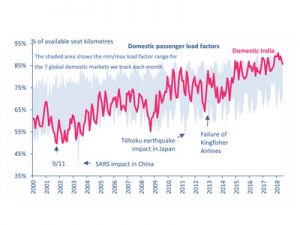

The India domestic passenger load factor exceeded 90 per cent for the first time ever in February 2018, hitting an all-time high for the other global domestic markets, namely China, the US, Brazil, Russia, Japan and Australia. According to International Air Transport Association (IATA), the bigger picture is that the current load factor performance represents a significant turnaround from the early-2000s when India regularly posted the lowest domestic passenger load factor amongst its group of countries, even dipping below 50 per cent on occasion. The evolution and maturity of India’s domestic air transport market can be illustrated by comparing the experiences around the time of 9/11 with that of late 2014. In the former, domestic capacity continued to increase even as demand slumped, while in late-2014 Indian airlines slowed capacity growth to support the load factor even as demand was growing strongly. In part, this appears to reflect the increasing influence of competitive (market) pressures over time via a mix of policy, regulatory and industry developments. Such forces have instilled a greater focus on airlines to achieve the load factor levels needed to generate adequate returns for their investors.

Read More »India now connects to more international cities through non-stop service

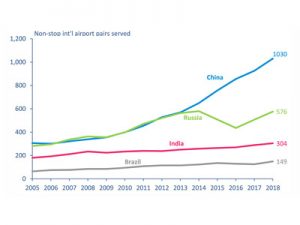

India has steadily increased the number of overseas city pairs served by a non-stop service from the country over time, according to a recent study by International Air Transport Association (IATA). There are 304 such international pairs in 2018, up from around 230 ten years ago. In relative terms, the India market appears to have considerably less international city pairs served than either China or Russia. However, Indian travellers have ready access (via the geographic proximity) to the Middle East superconnector hubs – Dubai, Abu Dhabi and Doha – that China and Russia do not. This increases the size of the network significantly for Indian travellers, as well as making India more accessible for international visitors. As such, it may go some way to explaining the relatively lower number of international city pairs for India relative to China and Russia.

Read More »Travelport becomes first GDS operator to offer NDC content

Travelport has become the first GDS operator to manage the live booking of flights using the International Air Transport Association’s (IATA) New Distribution Capability (NDC) technical standard. The first transaction was made by a British agency, Meon Valley Travel, on October 19 for a short-haul low-cost flight from London to Milan issued by a major European carrier. The new capability allows bookings to be made for any services on the airline without incurring a surcharge. Travelport’s new NDC capability is enabled using similar XML connections to those Travelport already deploys with APIs for over 20 low-cost carriers. The company published a roadmap for its initial range of NDC products in February, having been the first GDS operator in December 2017 to acquire Level 3 certification from IATA as an aggregator. It will also be followed by a series of product enhancements, including a version for online agents in 2019. Gordon Wilson, President and CEO, Travelport, said: “We are delighted to have taken a lead in bringing the NDC era to life. It has required an extraordinary amount of skill and expertise to make this happen and I want to thank my own colleagues at Travelport as well as our partners. We are still at the earliest stages of NDC deployment. Its evolution will continue to take time as we learn from the practical experience of its first use. Meanwhile, we continue to offer a comprehensive global travel commerce platform capable of handling mass volumes of searchable and bookable content at speed for the world’s travel providers and agents.”

Read More »Growth forecasts see Indian aviation receive 300% increase in passenger traffic by 2037

The International Air Transport Association (IATA), at International Aviation Summit held in Delhi, called on the government of India to maximise the potential contribution of aviation to India’s development by addressing infrastructure constraints that limit growth and government policies that impose excessive costs on aviation. Growth forecasts for India indicate a trebling of passenger demand by 2037 when some 500 million people are expected to fly to, from or within India. Already aviation supports 7.5 million Indian jobs and Rs 30 billion of GDP (1.5% of the economy). The Summit, being co-hosted by the Indian Ministry of Civil Aviation (MoCA), Airports Authority India (AAI) and IATA, commemorates the approaching milestone of 50-straight months of double digit domestic growth for Indian aviation. “While it is easy to find Indian passengers who want to fly, it’s very difficult for airlines to make money in this market. India’s social and economic development needs airlines to be able to profitably accommodate growing demand. We must address infrastructure constraints that limit growth and government policies that deviate from global standards and drive up the cost of connectivity,” said Alexandre de Juniac, Director General and CEO, IATA. India’s aviation infrastructure has benefitted from significant upgrades in recent years. “It is clear that India has the capacity to develop effective infrastructure. But the job is not done. Passenger numbers will grow. And infrastructure must not be a bottleneck in fulfilling the needs of travelers and the economy,” said de Juniac who called for work in four priority areas – develop a comprehensive and strategic master plan for India’s airports, remove all obstacles to successfully opening Navi Mumbai as quickly as possible, modernise airport processes using technology in …

Read More »October passenger demand bounces back after weather-hit September

Passenger demand in airlines rose 7.2 per cent in October compared to the same month last year, according to global passenger traffic results by International Air Transport Association (IATA). The capacity grew 6.2 per cent and load factor climbed 0.8 percentage points to 80.8 per cent, a record for the month. October’s performance was a strong rebound after the hurricane-related disruptions in September. Domestic and international travel growth largely was in balance. “As expected, the recent severe weather in the American region had only a temporary impact on the healthy travel demand we have seen this year, and we remain on course for another year of above-trend growth,” said Alexandre de Juniac, IATA’s Director General and CEO. For Asia-Pacific carriers, the large markets in India, China and Japan mean that domestic travel accounts for 45 per cent of the region’s operations. Asia-Pacific airlines led all regions with traffic growth of 10.3 per cent compared to the year-ago period, which was up from an 8.7 per cent rise in September. Capacity climbed 8.4 per cent and load factor rose 1.3 percentage points to 78.0 per cent.

Read More » Tourism Breaking News

Tourism Breaking News