Claiming that applying of CENVAT credit with 9 per cent service tax was cumbersome, Pronab Sarkar, President, IATO, said, “ GST was awaited for a long time and we were demanding from the government that since there is a lot of multiplicity of taxes in the tourism sector, the taxes should be rationalised and reduced. Thus, we were hoping to be put under the lowest GST slab and get some relief. I am glad that the government has agreed to both of them and has given us the same status what we wanted with 5 per cent GST rate. Also, there is no CENVAT credit on that. We are only concerned about one aspect of hotels, as they have put 28 per cent GST on hotels over Rs. 5000 which should not be more than 18 per cent. However, the hotel industry should come out and take up this issue. The government should encourage more tourists to come and not only look for more taxes. Rather, it should look for more tourists and get a bigger chunk of foreign exchange, which will not only generate revenue but also a lot of employment opportunities in the hospitality industry.”

Read More »Better than applying CENVAT credit: ADTOI

According to the GST Council, there will be 5 per cent GST on tours, said P.P. Khanna, President, ADTOI. However, he added that it is not clear whether this rate is applicable on value addition or gross amount. “In a way, the 5 per cent rate is good as we were already paying 4.5 per cent tax on the packages, and it is only 0.5 per cent more than that, which is tolerable. The service tax amendment of 9 per cent tax was more cumbersome for us, as applying for CENVAT credit was an issue, especially with small tour operators and small hotels not being systematic in generating proper invoices in our country. I think the government has taken special consideration for tour operators, as this process was difficult for us,” he shared.

Read More »A good step ahead: OTOAI

According to Guldeep Singh Sahni, President, OTOAI, the government went two steps back and now they have come one step ahead with the current GST rate. He revealed, “We were giving 4.5 per cent tax before January 22, 2017 and then we had CENVAT available. After January 22, we were under 9 per cent service tax. This step disturbed our summer bookings and there was a major loss of business to international OTAs. The new rates which will be implemented after the GST council’s meeting is 5% on supply of tour operators’ services. We need to clarify the meaning of this. If it is on the profit or add-on, then it’s very good. But if it is on the total amount, then we again stand expensive by 5 per cent than our international suppliers, because if we are taxing international hotels, then we are taxing them again. As input credit is not available it has direct impact on us.”

Read More »ATTOI’s technology conference in Kochi from June 8-10

The Association of Tourism Trade Organizations India (ATTOI) is organising an International Conference on Tourism Technology (ICTT) at the Le Meridien Kochi from June 8 to 10 with support from Kerala Tourism. ATTOI has been pushing for more travel and hospitality industry stakeholders in India to use technology to support and grow their businesses. Anish Kumar P.K, President, ATTOI, says, “Conventional tour operators, especially in India, may think online customer reviews and ratings or being present on the internet is secondary to their business, but they need to realize the impact that digital platforms are having on the decisions Indians make on holiday travel. If your website does not show up in Google searches, if you are not on Facebook or Twitter or Instagram, or responding to customer reviews on TripAdvisor and MyTourReview, you may be losing out on large volumes of business.” ATTOI has created a platform exclusively for costumer reviews for tour operators called MyTourReview. Anish Kumar adds, “The ICTT is a chance for travel businesses to learn from the experiences of people who have benefited tremendously from taking the technology route. Your consumers are not just sitting behind computers, they are making their searches on tablets and smartphones, so you need to make your presence felt on all devices.” He said the future of travel is certainly digital, and ATTOI is maximizing its use of technology, for instance in using live streaming as a promotional campaign tool for the upcoming second edition of ICTT. In December last year, ATTOI, as a curtain raiser to an international conference, organised a live streaming of an underwater engagement to showcase beach resorts as a unique offering of Kerala Tourism. Over …

Read More »Philippines will host 6th UNWTO Conference on Tourism Statistics

Policy leaders, statisticians, academicians and private sector will convene in Manila, The Philippines, from June 21-24, 2017, to discuss new methodologies to measure the full impacts of tourism. The 6th edition of the World Tourism Organization (UNWTO) International Conference on Statistics, an official event of the International Year of Sustainable Tourism for Development 2017, will address the topic of ‘Measuring Sustainable Tourism’. Supported by the United Nations Statistics Division, the UNWTO initiative ‘Towards a Statistical Framework for Measuring Sustainable Tourism’ (MST) underlines the need to measure the full effects of the tourism sector. The UNWTO International Conference to be held in Manila will serve as a platform to discuss the first draft of the MST framework and its future implementation. The Philippines has become a reference in the region with regard to tourism measurement and a role model in the development of effective inter-institutional collaboration to develop tourism statistics. The commitment of the country, shown in the development of the Tourism Satellite Account framework, explains the decision to host the discussion on the MST initiative. A Ministerial Roundtable will inaugurate the Conference in order to align efforts to advocate among governments the relevance of integrated and reliable data to manage and promote a more sustainable tourism sector. Afterwards, a Panel of Statistical Institutes will provide the opportunity to share experiences and practices implemented at global, regional and national level. Other technical sessions will focus on understanding data demands, the link between the economic, the environmental and the social dimensions of sustainable tourism, including job creation, sub-national measurement, Sustainable Development Goals (SDGs) indicators, and data sources including big data. Besides policy leaders, statistical experts and private sector, representatives from international organizations …

Read More »GITB 2017 opens with 275 foreign buyers and 288 exhibitors

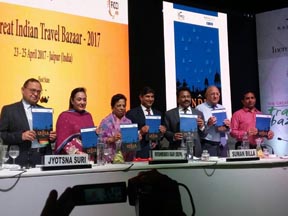

The Great Indian Travel Bazaar opened with 275 foreign buyers and 288 exhibitors at The Lalit Jaipur on April 23. The inbound show committed to boost tourism in India and in Rajasthan was inaugurated by Suman Billa, Joint Secretary, Ministry of Tourism, Government of India, and Krishnendra Kaur, Tourism, Art and Culture Minister, Government of Rajasthan, Jyotsna Suri, Chairperson, Tourism Committee FICCI, Nihal Chand Goel, Additional Chief Secretary (Tourism, Art & Culture), Bhim Singh, President, Federation of Hospitality and Tourism of Rajasthan, and Rahul Chakravarty, Senior Director and Head-Tourism, FICCI. Addressing the show, Billa said, India is truly on a growth path. We have grown at a rapid pace of 11 per cent in 2016 and since January to date we have grown at a staggering rate of 16 per cent, there is nothing in the market to suggest that it will slow down. Domestic tourism forms a key part of Indian tourism. Last year we had 1.7 billion domestic travellers and we are growing at 8-9 per cent Y-o-Y. Admittedly we are growing on a narrow base but the potential of tourism in India is immense. All of you here are at the right place to lay the seeds for what will become a great engagement for a market that has huge potential. He also informed that accordingly to the World Economic Forum report, India improved its tourism competitiveness by 25 places over three years and tourism is the government’s main agenda.

Read More »OTOAI Convention in Ras Al Khaimah from Sep 12-14

The Outbound Tour Operators Association of India (OTOAI) will be organising its 2017 Convention in Ras Al Khaimah in September. Guldeep Singh Sahni, President, OTOAI, and Haitham Mattar, CEO, Ras Al Khaimah Tourism Development, signed a MOU for the same at the Ras Al Khaimah Roadshow in Delhi. Sahni said, “We are going to have our convention most probably from September 12-14 in Ras Al Khaimah. The dates are tentative and will be finalised soon. We will be coming out with more details about the convention very soon. Our intention is to introduce new markets to the tour operators so that they have another destination in their kitty, which will add value to the already existing markets that they sell. If one looks at the numbers, there is a big gap between Dubai and Ras Al Khaimah, and we are looking at utilising that for the benefit of the tour operators so that they can extend their tours to this destination, with an added cost.”

Read More »End drunk driving, not hotels: HRAWI campaigns against liqour ban

Hotel and Restaurant Association of Western India (HRAWI), the apex body of restaurateurs and hoteliers of Western India, has initiated a full-fledged social media campaign on the recent issue of liquor ban. “Through the social media we will convey a few facts that, in normal times, would have been apparent. In the current state, unfortunately, facts are obscured by surround sound. The facts to be considered are alcoholism is a disease and a social evil; drunken driving is a crime; and, hotels and restaurants serve alcohol. What is of significance is that these facts are not correlated. Any arrow of continuity that may exist is forced. The compulsive alcoholic will find ways and means for consuming alcohol and he will continue to drive after drinking. Just as locking up girls at home is not a solution for preventing rapes, banning hotels from serving liquor cannot be a solution for ending the menace of drunk driving. Drunk driving is a crime, and it should be treated as one,” says Dilip Datwani, President, HRAWI. HRAWI will run a series of hashtags on Facebook that will try and explain some of the common misconceptions. “One million jobs, Rs. 200,000 crores loss to the exchequer, possible closure of 15,000 establishments is not a small thing. It is a huge social cost to pay. And we would not have minded being sacrificed if the ban were to yield any results. But reality is that all the job losses and other damages would be wasted. Statistics prove that there is a correlation between drunk driving and enforcement; and not between drunk driving and number of restaurants and bars. If true, there would be no drunk driving …

Read More »IATO opposes transport tax in Haryana

Pronab Sarkar, President, IATO, has said that the members of IATO are unhappy with the transport tax hike by the Transport Department of Haryana Government in the state. Addressing the monthly luncheon meeting of IATO, he said, “The transport tax in Haryana has been increased by 1700% from April 1, 2017. He said that while the government has increased this tax after four years, but such a steep hike is unacceptable. We will be meeting the Haryana Chief Minister as well as the Union Finance Minister to request them to implement any increase gradually.” Starting April 1, commercial vehicles entering Haryana would have to pay Rs. 3000.

Read More »Sunil Gadhiok is the new President, Skål Delhi

The Skål Delhi chapter has announced the Executive Committee for the term 2017-19 in which Sunil Gadhiok, who was earlier the Vice President, has now been elevated to the post of President. Similarly, the new core committee members include Greesh Bindra, Vice President; Ranjit Vig, Secretary; Ajay Bhatnagar, Treasurer; Sanjay Datta, Immediate past President; Homa Mistry, Member; Ankush Nijhawan, Member (Director Young Skål); Rajinder Rai, Member; Tekla Maira, New Member; Rohit Khosla, New Member, Sunny Sodhi, New Member. Speaking on the focus of the new committee, Sunil Gadhiok said, “With the commencement of the new team, we will continue aiding memberships to the chapter which currently stands at a 200-member strength. Skål Delhi is the second largest Skål chapter globally and our aim is to take it to the top. The Young Skål chapter has also been initiated and we would like to drive memberships to nurture talent and shape them into strong leaders of the future. In terms of club activities, members can expect more team-building activities and events that are in sync with the current happenings, along with expert speakers to give more value for the membership. CSR has always been one of our priorities and the emphasis will continue for the coming term.”

Read More » Tourism Breaking News

Tourism Breaking News