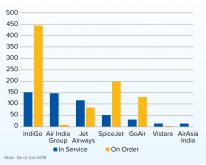

India’s airlines are expected to induct an unprecedented 124-130 aircraft in FY2018/2019, with IndiGo accounting for close to half of this number, according to CAPA estimates on South Asia Aviation Outlook 2018. All Indian LCCs, except AirAsia India, are profitable, and are expected to report a combined profit of USD450 million to USD500 million. In contrast, FSCs are projected to lose USD825 million to USD850 million, although most of this is accounted for by Air India. Vistara is also loss making, while Jet Airways will either report a modest profit or be closer to break even.

India’s airlines are expected to induct an unprecedented 124-130 aircraft in FY2018/2019, with IndiGo accounting for close to half of this number, according to CAPA estimates on South Asia Aviation Outlook 2018. All Indian LCCs, except AirAsia India, are profitable, and are expected to report a combined profit of USD450 million to USD500 million. In contrast, FSCs are projected to lose USD825 million to USD850 million, although most of this is accounted for by Air India. Vistara is also loss making, while Jet Airways will either report a modest profit or be closer to break even.

In 2018, Jet Airways is expected to place an additional order for 75 narrowbodies and to make a decision on its wide body plans, including the 10 787s on order that it has repeatedly deferred. Vistara will likely order 50 narrowbodies, together with a modest initial order for less than 10 widebodies, which may increase later. IndiGo and SpiceJet could place orders to support international expansion, including widebodies, and we do not rule out the possibility of a turboprop order by GoAir. Air India’s fleet plans are currently on hold pending its proposed privatisation.

Breaking News

- ITA Airways targets India-Italy demand, catering to rising premium and business travellers

- Indian travellers now stay 10–12 nights in Eurpoe, Europamundo adds Indian meals on tours

- Government plans built-in air ticket insurance in next 2-3 months offering up to 80% refund

- India needs structured farmer-hotel partnerships to boost rural livelihoods, tourism value chains: Suman Billa

- Tourism Office of Spain focuses on women travellers

- Explora Journeys and ClickMyCruise host an exclusive showcase event in Mumbai

- TripJack strengthens regional travel partnerships with a power-packed Chennai roadshow

- Bird Group recognised as ‘Best Aviation Group in India’ at India Travel Awards

- Sustainability to become default in hospitality as 2025 fuels industry optimism: Ramkumar

- 69% buyers took more domestic business trips last year, 68% travelled globally: Ravi Sattavan

- Northeast has transformed with huge infra boost; air traffic surges to 11 mn in 2024: Shekhawat

Tourism Breaking News

Tourism Breaking News